|

IN THIS ISSUE:

1a. General Domestic

Equity Mutual Funds — BUYBUY

1b. Domestic

Vanguard Mutual Funds — BUY

1c. Domestic

Fidelity Mutual Funds — BUY

1d. Domestic T. Rowe

Price Mutual Funds — BUY

1e. Domestic, Rydex

and ProFunds Funds — BUY

1f. Domestic

American Century Funds — BUY

2. Exchange Traded

Funds Master List

2a. Domestic

Exchange Traded Funds (ETFs) — BUY

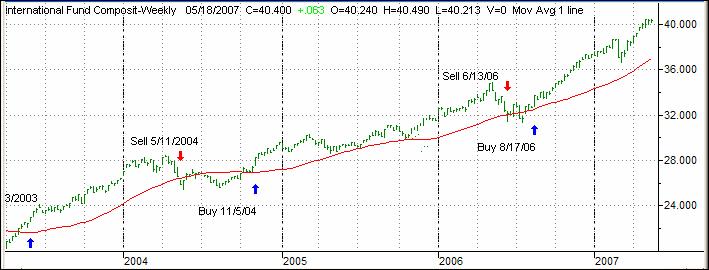

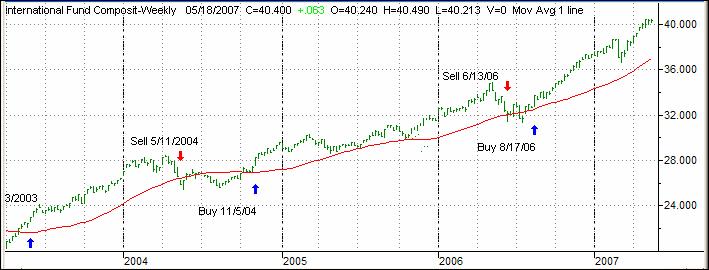

3. International

Equity Mutual Funds/ETFs — BUY

4a. A Global

Perspective — SELECTIVE BUY

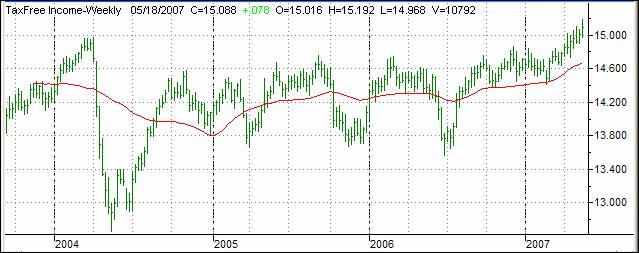

4b. Tax-Free

Investing — BUY

4c. Sector Fund

Investing (ETFs) — SELECTIVE

BUY

4d. Fidelity Select

Sector Funds — SELECTIVE BUY

4e. T. Rowe Price,

Rydex, VanguardNEW &

American Century Sector Funds — SELECTIVE BUY

4f. New Venture Opportunity ETFs —

SELECTIVE BUY

5. On the Horizon:

Bear Market Funds — SELL

6. 401(k) Funds

(domestic) — BUY

7. New Subscriber

Info

Weekly Market Comment:

The bulls

continued to party and sent all major indexes higher on overall good news

except for the housing sector.

Our

incremental buying procedure has us now in an almost 100% invested position.

TIP: To export the momentum tables to

your spreadsheet, here is an easy way to use Excel's functions to import the

weekly StatSheet data:

Open a new Excel worksheet. Go to

Data -> Import External Data and select "New Web Query."

In the address window, paste or type

in the link below. Enlarge the window so that you can see it better. By now

you should see my StatSheet tables. Click "Import" on the lower

right hand side. Select the A1 cell and click OK and all of the data is

neatly imported in columns.

You can now format the spreadsheet

and save it. Next week, simply change the address and you can import the

current data.

http://www.successful-investment.com/StatSheet/SSTables052407.htm

Are you interested in reading my

possibly politically incorrect ruminations about the market?

I have

set up a blog, aptly named “The Wall Street Bully,” which will be updated

during the week. It gives you the opportunity to post comments and continue

the dialog. Take a look at it:

http://thewallstreetbully.blogspot.com/

If you

have a newsreader, you can subscribe to it and new updates will be delivered

to you automatically. Alternatively, you can set this link up in your

‘Favorites’ folder and check at your convenience. This is a free service, so

please tell a couple of your friends.

GLOSSARY OF TERMS USED:

1. 4Wk, 8Wk, 12Wk and YTD refer to

how these funds have performed or “appreciated” during these various time

periods.

2. %M/A (39-week Simple Moving

Average) shows how far above or below its long-term trend line a fund/ETF is

currently positioned.

3. “Since 9/6/06” shows a fund’s

performance since that date. This date will be re-set once a new domestic Buy

Cycle starts.

4. DD% (DrawDown percentage) measures the drop from a

fund’s high to its current price during this Buy cycle

(since 9/6/06).

A fund that shows 0.00% has just made a new

high. That’s good news because it confirms that it

is moving up given current given economic conditions—which

were favorable at the time. It is therefore in tune

with market momentum.

Conversely, a fund with a large negative DD% number is a

lagging performer and should not be purchased at this time.

5. MaxDD%

(Maximum DrawDown percentage) is not

shown in these tables, but you will find me mention it quite frequently.

If you were to go back to the beginning of the previous

Buy cycle (10/5/04)

and measure DD% for a given fund every

trading day, and then select the worst (largest) DrawDown

number, you would have the information that I call

MaxDD% (Maximum DrawDown Percentage).

This allows me to look back at anytime and see which funds

have held up best and never hit our 7% sell stop.

Those are the ones with a low MaxDD% (or low volatility)

number and will be among my primary selections

for the next Buy cycle.

1a. DOMESTIC EQUITY MUTUAL FUNDS: BUY — since 9/6/2006

Our

average portfolio (over $50k) has returned +24.81%, after management fees,

for the Buy Cycle (from 4/29/03

to 5/18/04).

Our average

portfolio (over $50k) has returned +8.10%, after management fees, for the Buy

Cycle (from 10/5/04

to 5/17/06).

Past

performance is not a guarantee of future results.

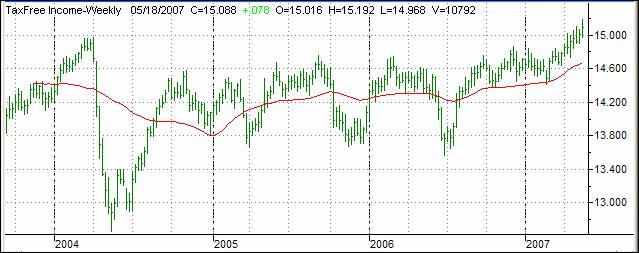

Our Trend

Tracking Index (TTI) moved higher this week (green line in above chart) and

now remains above its long term trend line (red) by +5.22%.

My sell

rules are as follows: I will liquidate any of my holdings if they drop by

more than 7% from their highs since I bought them, or if the TTI breaks below

its long-term tend line — whichever occurs first.

The first

table below shows the top 25 funds (out of 674) and is sorted by 4Wk

performance. Prices in all tables are updated through 5/17/2007, unless otherwise noted.

Please note, that I only track

no-load, no transaction fee or ‘load waived’ funds, which are available to me

through my custodian Charles Schwab & Co. Since all brokers and

custodians have different policies you need to check with yours first, before

placing any trades, as to no load availability and any charges or fees

involved.

I have identified those

funds, which are available to me as “load waived” funds or “advisor only”

funds, with an asterisk before their names. While this may not apply to all

brokerage firms, it should allow you to quickly locate those which are truly

no load.

|

Ticker

|

Fund Name

|

Orientation

|

4Wk

|

8Wk

|

12Wk

|

YTD

|

%M/A

|

Since 9/6/06

|

DD%

|

|

PDOWX

|

Potomac Dow 30 Plus Inv

|

Large Value

|

3.25%

|

10.95%

|

12.02%

|

9.39%

|

10.97%

|

21.90%

|

-1.06%

|

|

SVLSX

|

*Victory Value A

|

Large Value

|

3.00%

|

7.35%

|

7.92%

|

6.49%

|

8.05%

|

16.02%

|

-0.96%

|

|

ICBMX

|

ICON Materials

|

Mid-Cap Value

|

2.59%

|

7.78%

|

10.38%

|

17.35%

|

10.18%

|

13.62%

|

-2.00%

|

|

LSLTX

|

Leuthold Select Industries

|

Mid-Cap Growth

|

2.54%

|

8.37%

|

10.22%

|

11.25%

|

11.14%

|

23.54%

|

-1.34%

|

|

QUAGX

|

*Quaker Strategic Growth A

|

Large Blend

|

2.53%

|

7.32%

|

10.60%

|

9.88%

|

9.34%

|

14.40%

|

-1.43%

|

|

MGOAX

|

*Munder MidCap Select A

|

Mid-Cap Growth

|

2.51%

|

7.37%

|

10.36%

|

12.89%

|

11.41%

|

21.96%

|

-1.99%

|

|

IHSTX

|

*Hartford

Stock A

|

Large Blend

|

2.12%

|

7.56%

|

9.07%

|

8.48%

|

9.40%

|

20.20%

|

-0.78%

|

|

MSAVX

|

*Van Kampen American Value A

|

Mid-Cap Blend

|

2.11%

|

6.71%

|

7.93%

|

9.25%

|

10.36%

|

23.00%

|

-1.41%

|

|

GALEX

|

*Columbia

Disciplined Value T

|

Large Value

|

2.04%

|

6.38%

|

8.57%

|

8.75%

|

9.37%

|

18.89%

|

-1.04%

|

|

TGVFX

|

*Touchstone Growth Opportunities A

|

Large Growth

|

2.01%

|

7.22%

|

10.62%

|

8.31%

|

9.20%

|

17.75%

|

-1.46%

|

|

HFMCX

|

*Hartford

Midcap A

|

Mid-Cap Growth

|

2.01%

|

7.62%

|

8.89%

|

11.96%

|

10.88%

|

21.36%

|

-1.42%

|

|

HILVX

|

Harbor Large Cap Value Inv

|

Large Value

|

2.00%

|

7.23%

|

8.35%

|

5.08%

|

7.45%

|

16.24%

|

-0.95%

|

|

MVAAX

|

*MainStay Value A

|

Large Value

|

1.93%

|

6.37%

|

7.49%

|

6.80%

|

7.68%

|

15.03%

|

-1.09%

|

|

VGRIX

|

*JP Morgan Growth & Income A

|

Large Value

|

1.93%

|

6.93%

|

8.60%

|

8.28%

|

9.23%

|

19.53%

|

-1.16%

|

|

KDHAX

|

*Scudder Dreman High Return Eq A

|

Large Value

|

1.92%

|

5.85%

|

7.13%

|

5.05%

|

6.77%

|

12.66%

|

-0.95%

|

|

HMERX

|

*HighMark Large Cap Value Ret A

|

Large Value

|

1.91%

|

6.69%

|

8.79%

|

8.30%

|

9.19%

|

18.60%

|

-1.25%

|

|

NPRTX

|

Neuberger Berman Partners Inv

|

Large Blend

|

1.84%

|

8.09%

|

9.69%

|

9.40%

|

11.19%

|

21.79%

|

-1.28%

|

|

MUHLX

|

Muhlenkamp

|

Mid-Cap Value

|

1.84%

|

9.00%

|

9.19%

|

5.21%

|

7.79%

|

14.94%

|

-1.32%

|

|

SSHFX

|

Sound Shore

|

Large Value

|

1.84%

|

4.92%

|

5.30%

|

4.88%

|

6.26%

|

14.70%

|

-0.71%

|

|

ICSLX

|

ICAP Select Equity

|

Large Value

|

1.84%

|

6.48%

|

9.49%

|

8.45%

|

9.48%

|

18.93%

|

-0.90%

|

|

HDOGX

|

Hennessy Total Return

|

Large Value

|

1.81%

|

5.56%

|

6.48%

|

6.55%

|

6.73%

|

12.37%

|

-0.61%

|

|

SRVEX

|

*Victory Diversified Stock A

|

Large Blend

|

1.80%

|

7.10%

|

7.38%

|

6.72%

|

7.88%

|

17.82%

|

-0.99%

|

|

RIMEX

|

Rainier Core Equity

|

Large Blend

|

1.79%

|

6.89%

|

8.83%

|

9.34%

|

8.93%

|

17.96%

|

-1.47%

|

|

TGIGX

|

TCW Galileo Dividend Focused N

|

Large Value

|

1.77%

|

7.17%

|

8.37%

|

8.67%

|

9.07%

|

18.99%

|

-0.83%

|

|

WFMCX

|

*Wells Fargo Montgomery Mid Cap

Growth A

|

Mid-Cap Growth

|

1.75%

|

5.57%

|

6.90%

|

10.73%

|

9.74%

|

20.49%

|

-1.17%

|

The

following list shows the top 25 funds out of the 674 we track, but the

sorting order is by 12wk performance:

|

Ticker

|

Fund Name

|

Orientation

|

4Wk

|

8Wk

|

12Wk

|

YTD

|

%M/A

|

Since 9/6/06

|

DD%

|

|

TWHIX

|

American Century Heritage Inv

|

Mid-Cap Growth

|

1.22%

|

8.00%

|

12.92%

|

17.19%

|

16.16%

|

32.27%

|

-1.88%

|

|

TWCVX

|

American Century Vista

Inv

|

Mid-Cap Growth

|

0.77%

|

7.68%

|

12.06%

|

14.46%

|

12.98%

|

24.04%

|

-1.88%

|

|

SGRIX

|

Strong Growth & Income Inv

|

Large Blend

|

1.29%

|

9.75%

|

12.05%

|

9.65%

|

11.19%

|

26.31%

|

-0.89%

|

|

PDOWX

|

Potomac Dow 30 Plus Inv

|

Large Value

|

3.25%

|

10.95%

|

12.02%

|

9.39%

|

10.97%

|

21.90%

|

-1.06%

|

|

TGVFX

|

*Touchstone Growth Opportunities A

|

Large Growth

|

2.01%

|

7.22%

|

10.62%

|

8.31%

|

9.20%

|

17.75%

|

-1.46%

|

|

QUAGX

|

*Quaker Strategic Growth A

|

Large Blend

|

2.53%

|

7.32%

|

10.60%

|

9.88%

|

9.34%

|

14.40%

|

-1.43%

|

|

BUFEX

|

Buffalo Large Cap

|

Large Blend

|

0.09%

|

8.00%

|

10.54%

|

12.07%

|

10.45%

|

20.40%

|

-1.09%

|

|

HGOAX

|

*Hartford

Growth Opportunities A

|

Mid-Cap Growth

|

1.45%

|

8.43%

|

10.52%

|

10.28%

|

10.70%

|

22.09%

|

-1.68%

|

|

ICBMX

|

ICON Materials

|

Mid-Cap Value

|

2.59%

|

7.78%

|

10.38%

|

17.35%

|

10.18%

|

13.62%

|

-2.00%

|

|

MGOAX

|

*Munder MidCap Select A

|

Mid-Cap Growth

|

2.51%

|

7.37%

|

10.36%

|

12.89%

|

11.41%

|

21.96%

|

-1.99%

|

|

UMBIX

|

Excelsior Value & Restructuring

|

Large Value

|

1.39%

|

8.12%

|

10.24%

|

11.68%

|

11.50%

|

22.59%

|

-1.40%

|

|

LSLTX

|

Leuthold Select Industries

|

Mid-Cap Growth

|

2.54%

|

8.37%

|

10.22%

|

11.25%

|

11.14%

|

23.54%

|

-1.34%

|

|

LMGFX

|

Legg Mason Growth Trust F. I. Shares

|

Large Growth

|

1.53%

|

10.42%

|

10.21%

|

10.55%

|

11.34%

|

24.21%

|

-1.27%

|

|

ANOAX

|

*American Century New Oppor II A

|

Small Growth

|

0.77%

|

7.36%

|

10.19%

|

12.76%

|

11.40%

|

22.53%

|

-2.13%

|

|

JAEIX

|

Janus Core Equity

|

Large Blend

|

1.69%

|

8.11%

|

10.09%

|

9.38%

|

9.43%

|

17.59%

|

-1.06%

|

|

JAMRX

|

Janus Mercury

|

Large Growth

|

0.24%

|

6.98%

|

10.02%

|

14.51%

|

12.14%

|

25.71%

|

-1.51%

|

|

RYNVX

|

Rydex Nova Inv

|

Large Blend

|

1.05%

|

7.86%

|

9.84%

|

8.47%

|

9.79%

|

23.19%

|

-1.70%

|

|

FUNDX

|

FundX Upgrader (2%-30)

|

Mid-Cap Blend

|

0.24%

|

5.90%

|

9.83%

|

4.10%

|

8.18%

|

14.42%

|

-1.37%

|

|

FGSAX

|

*Federated Mid Cap Growth Strategies A

|

Mid-Cap Growth

|

0.17%

|

7.80%

|

9.83%

|

13.53%

|

11.59%

|

24.76%

|

-1.52%

|

|

ETMGX

|

*Eaton Vance Tax-Mgd Sm-Cap Gr 1.1 A

|

Small Growth

|

0.95%

|

7.55%

|

9.79%

|

15.70%

|

13.24%

|

28.23%

|

-1.99%

|

|

JAGIX

|

Janus Growth & Income

|

Large Growth

|

1.64%

|

7.67%

|

9.73%

|

8.73%

|

8.69%

|

15.41%

|

-1.02%

|

|

RIMSX

|

Rainier Small/Mid Cap Equity

|

Mid-Cap Growth

|

1.39%

|

6.83%

|

9.72%

|

13.41%

|

11.86%

|

23.80%

|

-2.04%

|

|

JSVAX

|

Janus Contrarian Fund

|

Mid-Cap Blend

|

0.41%

|

8.13%

|

9.71%

|

14.25%

|

13.85%

|

31.15%

|

-1.67%

|

|

NPRTX

|

Neuberger Berman Partners Inv

|

Large Blend

|

1.84%

|

8.09%

|

9.69%

|

9.40%

|

11.19%

|

21.79%

|

-1.28%

|

|

JORNX

|

Janus Orion

|

Mid-Cap Growth

|

1.00%

|

7.57%

|

9.69%

|

11.57%

|

11.19%

|

25.45%

|

-1.60%

|

In the

following table, the data has been filtered as follows:

It only

shows the top 25 funds with positive numbers in all momentum columns and a

DrawDown feature of less than -5% (DD%). The sorting order is by 4 weeks.

The

result is that only those funds with consistent performance in all areas are displayed,

which to me represent the top choices for fund selections. Out of a possible

674, 538 funds qualified and the top 25 are listed this week:

|

Ticker

|

Fund

Name

|

Orientation

|

4Wk

|

8Wk

|

12Wk

|

YTD

|

%M/A

|

Since 9/6/06

|

DD%

|

|

RYCVX

|

Rydex Dybamic Dow

(200%)

|

Large

Value

|

5.05%

|

17.73%

|

19.47%

|

14.36%

|

16.98%

|

34.93%

|

-1.73%

|

|

PDOWX

|

Potomac Dow 30 Plus Inv

|

Large

Value

|

3.25%

|

10.95%

|

12.02%

|

9.39%

|

10.97%

|

21.90%

|

-1.06%

|

|

SVLSX

|

*Victory Value A

|

Large

Value

|

3.00%

|

7.35%

|

7.92%

|

6.49%

|

8.05%

|

16.02%

|

-0.96%

|

|

IYJ

|

Dow Jones US

Industrial

|

Large

Blend

|

2.92%

|

7.62%

|

8.69%

|

10.46%

|

10.05%

|

20.84%

|

-0.81%

|

|

XLI

|

Industrial Select

Sector

|

Large

Value

|

2.85%

|

7.44%

|

8.48%

|

9.31%

|

8.77%

|

18.81%

|

-0.80%

|

|

RKGRX

|

Rockland Small Cap Growth

|

Small

Growth

|

2.70%

|

6.10%

|

6.98%

|

6.98%

|

7.16%

|

15.65%

|

-2.30%

|

|

ICBMX

|

ICON Materials

|

Mid-Cap

Value

|

2.59%

|

7.78%

|

10.38%

|

17.35%

|

10.18%

|

13.62%

|

-2.00%

|

|

LSLTX

|

Leuthold Select

Industries

|

Mid-Cap

Growth

|

2.54%

|

8.37%

|

10.22%

|

11.25%

|

11.14%

|

23.54%

|

-1.34%

|

|

QUAGX

|

*Quaker Strategic

Growth A

|

Large

Blend

|

2.53%

|

7.32%

|

10.60%

|

9.88%

|

9.34%

|

14.40%

|

-1.43%

|

|

MGOAX

|

*Munder MidCap

Select A

|

Mid-Cap

Growth

|

2.51%

|

7.37%

|

10.36%

|

12.89%

|

11.41%

|

21.96%

|

-1.99%

|

|

DIA

|

DIA Diamond EFT

|

Large

Value

|

2.48%

|

8.85%

|

9.76%

|

7.95%

|

8.98%

|

17.66%

|

-0.84%

|

|

IHSTX

|

*Hartford Stock A

|

Large

Blend

|

2.12%

|

7.56%

|

9.07%

|

8.48%

|

9.40%

|

20.20%

|

-0.78%

|

|

MSAVX

|

*Van Kampen American

Value A

|

Mid-Cap

Blend

|

2.11%

|

6.71%

|

7.93%

|

9.25%

|

10.36%

|

23.00%

|

-1.41%

|

|

GALEX

|

*Columbia Disciplined Value T

|

Large

Value

|

2.04%

|

6.38%

|

8.57%

|

8.75%

|

9.37%

|

18.89%

|

-1.04%

|

|

TGVFX

|

*Touchstone Growth

Opportunities A

|

Large

Growth

|

2.01%

|

7.22%

|

10.62%

|

8.31%

|

9.20%

|

17.75%

|

-1.46%

|

|

HFMCX

|

*Hartford Midcap A

|

Mid-Cap

Growth

|

2.01%

|

7.62%

|

8.89%

|

11.96%

|

10.88%

|

21.36%

|

-1.42%

|

|

HILVX

|

Harbor Large Cap

Value Inv

|

Large

Value

|

2.00%

|

7.23%

|

8.35%

|

5.08%

|

7.45%

|

16.24%

|

-0.95%

|

|

NY

|

NYSE 100 Index

|

Moderate

Allocation

|

2.00%

|

6.79%

|

8.13%

|

6.26%

|

7.46%

|

14.86%

|

-0.83%

|

|

MVAAX

|

*MainStay Value A

|

Large

Value

|

1.93%

|

6.37%

|

7.49%

|

6.80%

|

7.68%

|

15.03%

|

-1.09%

|

|

VGRIX

|

*JP Morgan Growth

& Income A

|

Large

Value

|

1.93%

|

6.93%

|

8.60%

|

8.28%

|

9.23%

|

19.53%

|

-1.16%

|

|

KDHAX

|

*Scudder Dreman High

Return Eq A

|

Large

Value

|

1.92%

|

5.85%

|

7.13%

|

5.05%

|

6.77%

|

12.66%

|

-0.95%

|

|

HMERX

|

*HighMark Large Cap

Value Ret A

|

Large

Value

|

1.91%

|

6.69%

|

8.79%

|

8.30%

|

9.19%

|

18.60%

|

-1.25%

|

|

JKF

|

Morningstar Large

Value

|

Large

Value

|

1.87%

|

6.35%

|

8.61%

|

6.78%

|

8.22%

|

15.30%

|

-1.23%

|

|

NPRTX

|

Neuberger Berman

Partners Inv

|

Large

Blend

|

1.84%

|

8.09%

|

9.69%

|

9.40%

|

11.19%

|

21.79%

|

-1.28%

|

|

MUHLX

|

Muhlenkamp

|

Mid-Cap

Value

|

1.84%

|

9.00%

|

9.19%

|

5.21%

|

7.79%

|

14.94%

|

-1.32%

|

TIP: Don’t forget to check the 401k funds

in section 6 as well, since many of them are available for all types of

investment accounts at different brokerage houses.

1b. DOMESTIC VANGUARD MUTUAL

FUNDS: BUY

If you

prefer using the Vanguard family, here are the most commonly held funds. The

sorting order is by 4wk momentum:

|

Ticker

|

Fund Name

|

Orientation

|

4Wk

|

8Wk

|

12Wk

|

YTD

|

%M/A

|

Since 9/6/06

|

DD%

|

|

VWNFX

|

Vanguard Windsor

II

|

Large Value

|

1.87%

|

6.51%

|

8.09%

|

8.09%

|

8.79%

|

17.33%

|

-0.90%

|

|

VIVAX

|

Vanguard Value Index

|

Large Value

|

1.44%

|

5.78%

|

7.73%

|

6.84%

|

8.11%

|

16.79%

|

-1.02%

|

|

VDIGX

|

Vanguard Dividend Growth

|

Large Value

|

1.41%

|

6.31%

|

7.63%

|

6.45%

|

7.71%

|

16.10%

|

-0.90%

|

|

VUVLX

|

U.S. Value Fund

|

Large Value

|

1.35%

|

5.82%

|

6.82%

|

6.13%

|

6.86%

|

14.35%

|

-0.72%

|

|

VWNDX

|

Vanguard Windsor

Fd

|

Large Value

|

1.35%

|

5.43%

|

6.17%

|

5.89%

|

7.47%

|

18.79%

|

-0.86%

|

|

VCVLX

|

Vanguard Capital Value

|

Large Value

|

1.26%

|

5.53%

|

6.08%

|

9.12%

|

9.66%

|

24.53%

|

-1.11%

|

|

VMGRX

|

Mid-Cap Growth Fund

|

Mid-Cap Growth

|

1.17%

|

5.99%

|

7.04%

|

10.15%

|

8.77%

|

20.13%

|

-1.73%

|

|

VTGIX

|

Tax-Managed Gr. & Inc.

|

Large Blend

|

1.03%

|

5.96%

|

7.45%

|

6.68%

|

7.48%

|

16.57%

|

-1.09%

|

|

VFINX

|

Vanguard 500 Index

|

Large Blend

|

1.00%

|

5.84%

|

7.32%

|

6.56%

|

7.34%

|

16.24%

|

-1.07%

|

|

VAAPX

|

Vanguard Asset Allocation

|

Moderate Allocation

|

0.96%

|

5.36%

|

6.70%

|

6.11%

|

6.95%

|

15.70%

|

-0.85%

|

|

VLACX

|

Vanguard Large-Cap Index

|

Large Blend

|

0.91%

|

5.69%

|

7.14%

|

6.82%

|

7.46%

|

16.65%

|

-1.10%

|

|

VEIPX

|

Vanguard Equity Income

|

Large Value

|

0.90%

|

4.55%

|

6.12%

|

5.95%

|

5.06%

|

9.41%

|

-1.07%

|

|

VMCAX

|

Tax-Managed Cap Apprec.

|

Large Blend

|

0.90%

|

6.08%

|

7.46%

|

7.59%

|

8.00%

|

17.75%

|

-1.17%

|

|

VDEQX

|

Diversified Equity

|

Large Blend

|

0.85%

|

5.58%

|

7.10%

|

7.63%

|

7.99%

|

18.64%

|

-1.25%

|

|

VWELX

|

Vanguard Wellington

|

Moderate Allocation

|

0.78%

|

3.70%

|

4.80%

|

4.77%

|

5.36%

|

11.21%

|

-0.82%

|

|

VTSMX

|

Vanguard Total Stock Fund

|

Large Blend

|

0.75%

|

5.45%

|

6.87%

|

6.84%

|

7.39%

|

16.73%

|

-1.14%

|

|

VMRGX

|

Vanguard Morgan Growth

|

Large Growth

|

0.56%

|

5.58%

|

7.39%

|

6.96%

|

7.57%

|

17.94%

|

-1.34%

|

|

VQNPX

|

Vanguard G & I

|

Large Blend

|

0.47%

|

4.23%

|

6.48%

|

6.42%

|

6.85%

|

16.21%

|

-1.22%

|

|

VGSTX

|

Vanguard STAR

|

Moderate Allocation

|

0.41%

|

3.44%

|

4.28%

|

4.95%

|

5.29%

|

12.03%

|

-0.69%

|

|

VIGRX

|

Growth Index Trust Fund

|

Large Growth

|

0.36%

|

5.55%

|

6.47%

|

6.77%

|

6.71%

|

16.34%

|

-1.14%

|

|

VISGX

|

Small-Cap Growth Index Fund

|

Small Growth

|

0.34%

|

5.94%

|

7.95%

|

10.92%

|

9.94%

|

22.67%

|

-1.87%

|

|

VBINX

|

Vanguard Balanced Index

|

Moderate Allocation

|

0.28%

|

3.05%

|

3.88%

|

4.41%

|

4.71%

|

10.89%

|

-0.73%

|

|

VPCCX

|

PRIMECAP Core Fd

|

Large Blend

|

0.07%

|

6.84%

|

7.34%

|

7.92%

|

7.21%

|

15.45%

|

-0.86%

|

|

VCVSX

|

Convertible Securities

|

Convertibles

|

0.06%

|

2.81%

|

3.41%

|

4.96%

|

4.65%

|

10.29%

|

-0.68%

|

|

VWUSX

|

Vanguard U.S. Growth Fd

|

Large Growth

|

0.00%

|

4.41%

|

5.60%

|

5.77%

|

5.48%

|

13.69%

|

-1.42%

|

|

VWINX

|

Vanguard Wellesley Inc.

|

Conservative Allocation

|

0.00%

|

1.22%

|

1.95%

|

2.92%

|

3.10%

|

7.11%

|

-0.67%

|

|

VEXPX

|

Vanguard Explorer

|

Small Growth

|

-0.02%

|

4.66%

|

5.49%

|

7.72%

|

6.81%

|

16.63%

|

-1.50%

|

|

VIMSX

|

Vanguard Mid-Cap Index

|

Mid-Cap Blend

|

-0.13%

|

5.00%

|

6.14%

|

9.50%

|

8.57%

|

20.09%

|

-1.53%

|

|

VEXMX

|

Vanguard Extended Mkt

|

Mid-Cap Blend

|

-0.18%

|

4.23%

|

5.45%

|

8.27%

|

7.87%

|

19.43%

|

-1.77%

|

|

VTMSX

|

Tax-Managed Small-Cap

|

Small Blend

|

-0.21%

|

3.98%

|

6.17%

|

7.35%

|

7.31%

|

17.60%

|

-1.88%

|

|

VSEQX

|

Vanguard Strategic Equity

|

Mid-Cap Blend

|

-0.36%

|

3.97%

|

5.22%

|

8.12%

|

7.27%

|

17.67%

|

-1.57%

|

|

NAESX

|

Vanguard Small Cap Index

|

Small Blend

|

-0.38%

|

4.28%

|

5.57%

|

7.59%

|

7.49%

|

18.51%

|

-1.88%

|

|

VGEQX

|

Vanguard Growth Equity

|

Large Growth

|

-0.76%

|

4.80%

|

6.22%

|

6.41%

|

6.04%

|

15.59%

|

-1.59%

|

|

VISVX

|

Vanguard Small-Cap Value

|

Small Value

|

-1.05%

|

2.78%

|

3.45%

|

4.60%

|

5.31%

|

14.98%

|

-1.87%

|

1c. DOMESTIC FIDELITY MUTUAL

FUNDS: BUY

Most

likely you have a reason to follow and track Fidelity funds, be it for your

401k, IRA or brokerage account. The table below lists the most commonly held

ones, sorted by the 4wk momentum column:

|

Ticker

|

Fund Name

|

Orientation

|

4Wk

|

8Wk

|

12Wk

|

YTD

|

%M/A

|

Since 9/6/06

|

DD%

|

|

FLVCX

|

Fidelity Leveraged Stock Fd

|

Mid-Cap Blend

|

2.02%

|

8.85%

|

11.43%

|

16.02%

|

14.07%

|

24.80%

|

-1.68%

|

|

FCPGX

|

Fidelity Small Cap Growth

|

Small Growth

|

1.83%

|

7.01%

|

9.11%

|

13.11%

|

11.82%

|

24.44%

|

-1.71%

|

|

FDGFX

|

Fidelity Div. Growth

|

Large Blend

|

1.73%

|

6.30%

|

7.01%

|

6.48%

|

7.24%

|

15.45%

|

-0.68%

|

|

FDFFX

|

Fidelity Independence Fd

|

Large Growth

|

1.71%

|

7.54%

|

10.26%

|

9.81%

|

9.70%

|

18.68%

|

-2.09%

|

|

FBCVX

|

Fidelity Blue Chip

|

Large Value

|

1.59%

|

6.33%

|

8.13%

|

8.88%

|

9.29%

|

18.91%

|

-1.09%

|

|

FEQIX

|

Fidelity Equity Income

|

Large Value

|

1.52%

|

5.87%

|

7.08%

|

6.89%

|

7.78%

|

16.45%

|

-0.86%

|

|

FEQTX

|

Fidelity Equity Income II

|

Large Value

|

1.15%

|

5.51%

|

6.75%

|

6.72%

|

7.26%

|

15.90%

|

-0.74%

|

|

FDSCX

|

Fidelity Small Cap Independence

|

Small Growth

|

1.11%

|

5.61%

|

7.09%

|

9.75%

|

10.22%

|

21.98%

|

-1.33%

|

|

FDSVX

|

Fidelity Discovery Fd

|

Large Blend

|

1.07%

|

6.73%

|

8.62%

|

6.81%

|

7.41%

|

14.81%

|

-1.26%

|

|

FGRTX

|

Fidelity Gr. & Income II

|

Large Blend

|

1.04%

|

5.70%

|

7.40%

|

7.13%

|

7.31%

|

15.67%

|

-1.10%

|

|

FSMAX

|

Fidelity Spartan 500 Index-Advant.

|

Large Blend

|

1.04%

|

6.10%

|

7.64%

|

6.87%

|

7.68%

|

17.06%

|

-1.11%

|

|

FUSVX

|

Fid. U.S. Equity Index-Advant.

|

Large Blend

|

1.03%

|

6.10%

|

7.64%

|

6.87%

|

7.67%

|

17.05%

|

-1.12%

|

|

FDSSX

|

Fidelity Stock Selector

|

Large Blend

|

1.03%

|

5.84%

|

7.63%

|

7.44%

|

7.58%

|

16.30%

|

-1.14%

|

|

FSMKX

|

Fidelity Spartan 500 Index-Invest.

|

Large Blend

|

1.02%

|

6.01%

|

7.53%

|

6.76%

|

7.56%

|

16.77%

|

-1.10%

|

|

FUSEX

|

Fidelity Spartan Index

|

Large Blend

|

1.00%

|

5.89%

|

7.38%

|

6.63%

|

7.41%

|

16.42%

|

-1.07%

|

|

FFIDX

|

Fidelity Fund

|

Large Blend

|

0.99%

|

6.06%

|

8.32%

|

8.11%

|

8.10%

|

17.10%

|

-1.32%

|

|

FLPSX

|

Fidelity Low Price Stock

|

Small Value

|

0.96%

|

4.69%

|

6.52%

|

6.90%

|

7.95%

|

17.16%

|

-0.96%

|

|

FVDFX

|

Fidelity Value Discovery

|

Mid-Cap Blend

|

0.89%

|

6.37%

|

7.83%

|

9.57%

|

8.98%

|

17.46%

|

-1.50%

|

|

FLCSX

|

Fidelity Large Cap Stock Fd

|

Large Growth

|

0.88%

|

7.07%

|

8.14%

|

8.75%

|

8.98%

|

19.18%

|

-1.07%

|

|

FTQGX

|

Fidelity Focused Stock Fd

|

Large Growth

|

0.87%

|

7.24%

|

8.33%

|

10.65%

|

9.10%

|

16.39%

|

-1.63%

|

|

FDEQX

|

Fidelity Disciplined Equity

|

Large Blend

|

0.87%

|

6.14%

|

8.48%

|

8.95%

|

8.97%

|

18.89%

|

-1.33%

|

|

FSTVX

|

Fid. Total Mkt Index-Advant.

|

Large Blend

|

0.74%

|

5.65%

|

7.13%

|

7.13%

|

7.74%

|

17.61%

|

-1.21%

|

|

FSTMX

|

Fid. Total Mkt. Index-Invest.

|

Large Blend

|

0.73%

|

5.60%

|

7.05%

|

7.05%

|

7.65%

|

17.41%

|

-1.19%

|

|

FDGRX

|

Fidelity Growth

|

Large Growth

|

0.73%

|

7.21%

|

8.48%

|

6.99%

|

7.97%

|

19.13%

|

-1.89%

|

|

FCNTX

|

Fidelity Contrafund

|

Large Blend

|

0.72%

|

4.67%

|

6.41%

|

6.11%

|

6.44%

|

14.32%

|

-1.12%

|

|

FEXPX

|

Fidelity Export/Multinational

|

Large Blend

|

0.70%

|

4.97%

|

7.16%

|

7.54%

|

6.98%

|

14.65%

|

-1.16%

|

|

FDCAX

|

Fidelity Cap. Apprec.

|

Large Growth

|

0.59%

|

4.85%

|

6.14%

|

6.64%

|

6.78%

|

15.91%

|

-0.81%

|

|

FFNOX

|

Fidelity Four-in-One Index

|

Large Blend

|

0.51%

|

4.50%

|

6.07%

|

6.31%

|

6.89%

|

15.39%

|

-0.90%

|

|

FSLVX

|

Fidelity Large Cap Value Fd

|

Large Value

|

0.47%

|

4.71%

|

7.47%

|

7.74%

|

7.96%

|

16.45%

|

-1.66%

|

|

FGRIX

|

Fidelity Growth & Income

|

Large Cap

|

0.46%

|

4.20%

|

4.20%

|

4.05%

|

4.80%

|

11.29%

|

-0.61%

|

|

FSCRX

|

Fidelity Small Cap Retirement

|

Small Blend

|

0.45%

|

6.12%

|

7.01%

|

8.21%

|

7.45%

|

15.34%

|

-1.36%

|

|

FSLSX

|

Fidelity Value Strategy

|

Small Blend

|

0.28%

|

4.74%

|

6.16%

|

10.10%

|

9.18%

|

19.93%

|

-1.40%

|

|

FSLCX

|

Fidelity Small Cap Stock

|

Small Blend

|

0.25%

|

4.45%

|

6.10%

|

7.95%

|

7.52%

|

15.99%

|

-1.31%

|

|

FMILX

|

Fidelity New Millennium Fd

|

Mid-Cap Growth

|

0.21%

|

3.69%

|

4.99%

|

5.40%

|

6.20%

|

16.91%

|

-1.09%

|

|

FDVLX

|

Fidelity Value

|

Mid-Cap Value

|

0.18%

|

4.80%

|

5.60%

|

8.99%

|

8.36%

|

18.36%

|

-1.39%

|

|

FBGRX

|

Fidelity Blue Chip Growth

|

Large Growth

|

0.14%

|

5.89%

|

6.60%

|

5.25%

|

5.39%

|

12.30%

|

-1.28%

|

|

FMAGX

|

Fidelity Magellan

|

Large Blend

|

0.08%

|

4.78%

|

5.91%

|

6.42%

|

5.96%

|

12.42%

|

-1.05%

|

|

FCPVX

|

Fidelity Small Cap Value

|

Small Value

|

0.00%

|

4.65%

|

5.89%

|

7.65%

|

7.85%

|

19.13%

|

-1.82%

|

|

FMCSX

|

Fidelity Mid-Cap Stock Fd

|

Mid-Cap Growth

|

-0.23%

|

5.76%

|

7.51%

|

12.18%

|

9.86%

|

20.46%

|

-1.57%

|

|

FSEMX

|

Fid. Extended Mkt Index-Invest.

|

Mid-Cap Blend

|

-0.23%

|

3.99%

|

5.13%

|

7.74%

|

7.65%

|

19.10%

|

-1.66%

|

|

FSEVX

|

Fid. Extended Mkt Index-Advant.

|

Mid-Cap Blend

|

-0.23%

|

4.01%

|

5.16%

|

7.79%

|

7.69%

|

19.20%

|

-1.67%

|

|

FFTYX

|

Fidelity Fifty

|

Large Blend

|

-0.51%

|

4.03%

|

6.91%

|

8.31%

|

7.97%

|

18.07%

|

-1.40%

|

|

FNCMX

|

Fidelity Nasdaq Comp. Index

|

Large Growth

|

-0.57%

|

4.91%

|

5.54%

|

5.22%

|

5.60%

|

17.18%

|

-1.90%

|

|

FOCPX

|

Fidelity OTC

|

Large Growth

|

-0.60%

|

4.67%

|

6.63%

|

6.32%

|

6.71%

|

20.84%

|

-2.16%

|

|

FDEGX

|

Fidelity Aggr. Growth

|

Mid-Cap Growth

|

-0.61%

|

7.32%

|

7.86%

|

9.64%

|

9.55%

|

23.89%

|

-1.94%

|

|

FTRNX

|

Fidelity Trend Fund

|

Large Blend

|

-0.61%

|

4.54%

|

5.88%

|

4.51%

|

5.24%

|

12.99%

|

-1.63%

|

|

FSMVX

|

Fidelity Mid Cap Value

|

Mid-Cap Value

|

-0.83%

|

3.74%

|

6.08%

|

9.95%

|

8.51%

|

18.44%

|

-1.94%

|

|

FSMGX

|

Fidelity Mid Cap Growth

|

Mid-Cap Growth

|

-1.48%

|

3.10%

|

4.51%

|

4.94%

|

5.52%

|

17.62%

|

-2.24%

|

|

FSLGX

|

Fidelity Large Cap Growth

|

Large Growth

|

-1.49%

|

3.13%

|

4.68%

|

3.21%

|

4.61%

|

15.17%

|

-2.03%

|

1d. DOMESTIC T. ROWE PRICE MUTUAL

FUNDS: BUY

This new

addition to our StatSheet allows you to track T. Rowe Price’s funds

separately, in case you prefer having your account with them. Below are their

most commonly held funds:

|

Ticker

|

Fund Name

|

Orientation

|

4Wk

|

8Wk

|

12Wk

|

YTD

|

%M/A

|

Since 9/6/06

|

DD%

|

|

TRVLX

|

T. Rowe Price Value

|

Large Value

|

1.58%

|

7.37%

|

8.44%

|

8.40%

|

9.23%

|

19.74%

|

-0.88%

|

|

TRMCX

|

T. Rowe Price Mid-Cap Value

|

Mid-Cap Value

|

1.29%

|

5.57%

|

5.94%

|

8.09%

|

8.70%

|

19.44%

|

-0.96%

|

|

PRCOX

|

T. Rowe Price Cap. Opp.

|

Large Blend

|

1.28%

|

6.50%

|

7.88%

|

7.22%

|

8.03%

|

17.83%

|

-1.08%

|

|

PRDSX

|

T. Rowe Price Diversified Sm. Gr.

|

Small Growth

|

1.22%

|

6.20%

|

7.36%

|

8.77%

|

8.03%

|

17.10%

|

-1.87%

|

|

PRWCX

|

T. Rowe Price Cap. Apprec.

|

Moderate Allocation

|

1.07%

|

4.52%

|

5.17%

|

5.87%

|

6.48%

|

14.10%

|

-0.51%

|

|

PREIX

|

T. Rowe Price Equ. Index 500

|

Large Blend

|

0.98%

|

5.94%

|

7.41%

|

6.60%

|

7.41%

|

16.46%

|

-1.10%

|

|

PRGIX

|

T. Rowe Price G&I

|

Large Blend

|

0.94%

|

5.00%

|

5.39%

|

5.25%

|

6.02%

|

13.54%

|

-0.89%

|

|

PRSGX

|

T. Rowe Price Spectrum

|

Large Blend

|

0.86%

|

6.29%

|

7.86%

|

7.91%

|

8.77%

|

19.52%

|

-0.98%

|

|

POMIX

|

T. Rowe Price Tot. Equity Index

|

Large Blend

|

0.77%

|

5.67%

|

7.00%

|

7.07%

|

7.65%

|

17.53%

|

-1.22%

|

|

TRBCX

|

T. Rowe Blue Chip Growth

|

Large Growth

|

0.77%

|

7.55%

|

8.71%

|

7.99%

|

8.46%

|

18.40%

|

-1.16%

|

|

PRWAX

|

T. Rowe Price New America

|

Large Growth

|

0.60%

|

5.68%

|

6.40%

|

6.96%

|

6.86%

|

16.34%

|

-1.32%

|

|

PRGFX

|

T. Rowe Price Growth

|

Large Growth

|

0.40%

|

6.86%

|

8.01%

|

7.62%

|

8.37%

|

19.06%

|

-0.96%

|

|

PRDMX

|

T. Rowe Price Div. Mid-Cap Gr.

|

Mid-Cap Growth

|

0.27%

|

6.22%

|

6.68%

|

9.59%

|

8.68%

|

20.52%

|

-1.72%

|

|

PRNHX

|

T. Rowe Price New Horizons

|

Small Growth

|

0.13%

|

3.81%

|

5.03%

|

7.20%

|

6.67%

|

16.45%

|

-1.36%

|

|

PREFX

|

T. Rowe Price Tax-Efficient Multi

|

Mid-Cap Growth

|

0.00%

|

5.43%

|

5.77%

|

7.67%

|

7.40%

|

18.39%

|

-1.57%

|

|

PTEGX

|

T. Rowe Price Tax-Efficient Gr.

|

Large Growth

|

-0.18%

|

5.46%

|

5.56%

|

5.95%

|

6.12%

|

15.74%

|

-1.21%

|

|

PEXMX

|

T. Rowe Price Ext. Equ. Mkt. Ind.

|

Mid-Cap Blend

|

-0.33%

|

4.06%

|

5.20%

|

7.44%

|

7.63%

|

19.50%

|

-1.83%

|

1e. DOMESTIC RYDEX AND PROFUNDS: BUY

These

aggressive fund families are supporting the investing public by having the

most generous trading policies in the industry. If you don’t have an account

directly with them, check with your custodian about any fees that might

affect you.

Here are

the most commonly held funds:

|

Ticker

|

Fund Name

|

Orientation

|

4Wk

|

8Wk

|

12Wk

|

YTD

|

%M/A

|

Since 9/6/06

|

DD%

|

|

RYCVX

|

Rydex Dybamic Dow (200%)

|

Large Value

|

5.05%

|

17.73%

|

19.47%

|

14.36%

|

16.98%

|

34.93%

|

-1.73%

|

|

RYTNX

|

Rydex Titan 500 H (200%)

|

Large Blend

|

1.53%

|

11.34%

|

13.83%

|

10.74%

|

12.55%

|

29.87%

|

-2.28%

|

|

LVPIX

|

ProFunds Large Cap Value Inv

|

Large Value

|

1.30%

|

6.09%

|

7.58%

|

7.18%

|

8.26%

|

18.12%

|

-1.14%

|

|

RYBHX

|

Rydex Mid Cap Growth

|

Mid-Cap Growth

|

1.09%

|

6.13%

|

7.49%

|

10.39%

|

9.51%

|

22.22%

|

-1.46%

|

|

RYNAX

|

Rydex Nova

|

Large Blend

|

0.98%

|

7.73%

|

9.66%

|

8.23%

|

9.55%

|

22.70%

|

-1.72%

|

|

BLPIX

|

ProFunds Bull Inv

|

Large Blend

|

0.97%

|

5.98%

|

7.44%

|

6.37%

|

7.24%

|

16.25%

|

-1.14%

|

|

MGPIX

|

ProFunds Mid Cap Growth Inv

|

Mid-Cap Growth

|

0.90%

|

6.12%

|

7.88%

|

11.81%

|

9.63%

|

20.04%

|

-1.60%

|

|

RYSRX

|

Rydex Sector Rotation H

|

Mid-Cap Blend

|

0.78%

|

6.44%

|

7.55%

|

8.83%

|

9.40%

|

19.83%

|

-2.27%

|

|

LGPIX

|

ProFunds Large Cap Growth Inv

|

Large Growth

|

0.39%

|

5.46%

|

6.78%

|

5.08%

|

5.80%

|

13.56%

|

-1.11%

|

|

RYZAX

|

Rydex Large Cap Value

|

Large Value

|

0.17%

|

4.61%

|

6.04%

|

8.28%

|

8.34%

|

18.49%

|

-1.78%

|

|

RYMDX

|

Rydex Medius (150%)

|

Mid-Cap Blend

|

0.02%

|

7.08%

|

8.76%

|

14.07%

|

11.98%

|

27.31%

|

-2.71%

|

|

MDPIX

|

ProFunds Mid Cap Inv

|

Mid-Cap Blend

|

-0.04%

|

4.95%

|

6.29%

|

10.33%

|

8.62%

|

18.89%

|

-1.90%

|

|

SGPIX

|

ProFunds Small Cap Growth Inv

|

Small Growth

|

-0.17%

|

4.03%

|

6.75%

|

8.41%

|

7.69%

|

17.92%

|

-1.90%

|

|

RYQMX

|

Rydex Core Equity H

|

Mid-Cap Blend

|

-0.24%

|

3.89%

|

5.18%

|

5.34%

|

6.04%

|

15.36%

|

-1.31%

|

|

RYWAX

|

Rydex Small Cap Growth

|

Small Growth

|

-0.35%

|

2.63%

|

5.31%

|

5.66%

|

6.09%

|

17.56%

|

-2.08%

|

|

RYAWX

|

Rydex Large Cap Growth

|

Large Growth

|

-0.38%

|

5.18%

|

6.04%

|

6.87%

|

6.29%

|

14.81%

|

-1.11%

|

|

SVPIX

|

ProFunds Small Cap Value Inv

|

Small Value

|

-0.45%

|

3.61%

|

5.02%

|

5.54%

|

6.05%

|

15.91%

|

-1.81%

|

|

OTPIX

|

ProFunds OTC Inv

|

Large Growth

|

-0.81%

|

5.56%

|

6.55%

|

6.20%

|

5.97%

|

18.25%

|

-2.18%

|

|

MLPSX

|

ProFunds Mid Cap Value

|

Mid-Cap Value

|

-0.82%

|

3.67%

|

4.62%

|

8.60%

|

7.36%

|

16.95%

|

-2.08%

|

|

SLPIX

|

ProFunds Small Cap Inv

|

Small Blend

|

-0.87%

|

3.33%

|

4.18%

|

4.55%

|

5.16%

|

14.70%

|

-1.87%

|

|

RYAOX

|

Rydex OTC

|

Large Growth

|

-0.92%

|

5.31%

|

6.64%

|

6.07%

|

6.00%

|

18.43%

|

-2.06%

|

|

RYAVX

|

Rydex Mid Cap Value

|

Mid-Cap Value

|

-1.22%

|

3.11%

|

3.67%

|

8.16%

|

7.60%

|

19.69%

|

-2.08%

|

|

RYMKX

|

Rydex Mekros (150%)

|

Small Blend

|

-1.94%

|

4.28%

|

6.08%

|

6.22%

|

7.10%

|

22.10%

|

-2.92%

|

|

RYAZX

|

Rydex Small Cap Value

|

Small Value

|

-1.97%

|

1.94%

|

2.36%

|

3.92%

|

5.08%

|

15.90%

|

-2.26%

|

|

RYVYX

|

Rydex Velocity 100 H (200%)

|

Large Growth

|

-2.00%

|

10.43%

|

12.01%

|

10.29%

|

9.75%

|

33.40%

|

-4.23%

|

1f. DOMESTIC AMERICAN CENTURY

FUNDS: BUY

Here’s

another addition to my StatSheet featuring the most widely held funds of the

American Century family:

|

Ticker

|

Fund Name

|

Orientation

|

4Wk

|

8Wk

|

12Wk

|

YTD

|

%M/A

|

Since 9/6/06

|

DD%

|

|

BIGRX

|

American Century Income

|

Large Value

|

1.54%

|

6.72%

|

8.31%

|

7.23%

|

8.54%

|

18.64%

|

-0.87%

|

|

ACTIX

|

American Century Capital Val

|

Large Value

|

1.41%

|

6.11%

|

7.94%

|

6.23%

|

7.82%

|

16.52%

|

-1.05%

|

|

AAGPX

|

American AAdvantage Lg Cap Val.

|

Large Value

|

1.28%

|

5.94%

|

7.42%

|

7.20%

|

8.13%

|

17.33%

|

-1.03%

|

|

TWHIX

|

American Century Heritage Inv

|

Mid-Cap Growth

|

1.22%

|

8.00%

|

12.92%

|

17.19%

|

16.16%

|

32.27%

|

-1.88%

|

|

ACMVX

|

American Century Mid Cap Val.

|

Mid-Cap Value

|

1.12%

|

5.23%

|

6.18%

|

8.52%

|

8.76%

|

20.01%

|

-1.09%

|

|

AAFPX

|

American AAdvantage S&P 500

|

Large Blend

|

0.97%

|

5.54%

|

7.01%

|

6.14%

|

6.99%

|

15.86%

|

-1.14%

|

|

TWCVX

|

American Century Vista

Inv

|

Mid-Cap Growth

|

0.77%

|

7.68%

|

12.06%

|

14.46%

|

12.98%

|

24.04%

|

-1.88%

|

|

BEQGX

|

American Century Equity Gr.

|

Large Blend

|

0.69%

|

5.51%

|

7.98%

|

6.59%

|

7.40%

|

16.73%

|

-1.22%

|

|

AABPX

|

American AAdvantage Bal.

|

Moderate Allocation

|

0.60%

|

3.56%

|

4.27%

|

4.51%

|

5.22%

|

11.78%

|

-0.70%

|

|

TWEIX

|

American Century Equity Inc.

|

Mid-Cap Value

|

0.51%

|

3.06%

|

4.34%

|

4.06%

|

4.81%

|

10.81%

|

-0.76%

|

|

TWBIX

|

American Century Balanced Inv

|

Moderate Allocation

|

0.20%

|

2.81%

|

4.11%

|

3.95%

|

4.29%

|

9.86%

|

-0.77%

|

2. EXCHANGE TRADED FUNDS MASTER

LIST

As per request,

I have added this ETF Master list so that you can quickly compare various

ETFs without having to reference other tables. The ETFs listed in the table

(160) consist of the following orientations: Domestic, International,

Country, Sector and Specialty. Momentum figures for all ETFs are not adjusted

for dividends.

The

sorting order is by 4wk momentum.

|

Ticker

|

Fund Name

|

Orientation

|

4Wk

|

8Wk

|

12Wk

|

YTD

|

%M/A

|

DD%

|

|

CH

|

Chile Fund

|

Chile Stock

|

13.39%

|

23.71%

|

26.91%

|

27.66%

|

23.13%

|

0.00%

|

|

EWC

|

iShares Canada Index

|

Foreign Large Value

|

6.28%

|

12.32%

|

16.63%

|

16.63%

|

15.28%

|

-1.80%

|

|

EWW

|

iShares Mexico Index

|

Latin America Stock

|

5.97%

|

10.22%

|

20.06%

|

16.92%

|

19.52%

|

-2.46%

|

|

EWZ

|

iShares Brazil Index

|

Latin America Stock

|

5.06%

|

13.65%

|

23.90%

|

19.74%

|

22.48%

|

-4.92%

|

|

PXJ

|

Dynamic Oil & Gas Services

|

Oil & Gas

|

4.94%

|

14.13%

|

23.75%

|

21.88%

|

20.26%

|

-3.47%

|

|

IYZ

|

Down Jones US Telecom

|

Specialty-Commun.

|

4.83%

|

8.17%

|

10.23%

|

13.42%

|

13.33%

|

-0.80%

|

|

VOX

|

Vanguard Telecom Serv's

|

Specialty-Commun.

|

4.39%

|

7.36%

|

8.51%

|

11.48%

|

11.61%

|

-0.92%

|

|

IGE

|

Goldman Sachs Natural Res.

|

Specialty-Natural Res.

|

4.34%

|

9.85%

|

16.59%

|

14.69%

|

15.01%

|

-2.35%

|

|

ILF

|

iShares S&P 40 Latin America

|

Latin America Stock

|

4.22%

|

12.29%

|

21.67%

|

18.08%

|

20.21%

|

-4.34%

|

|

IXC

|

S&P Global Energy

|

Specialty-Natural Res.

|

4.21%

|

9.16%

|

17.30%

|

10.35%

|

12.64%

|

-1.93%

|

|

XLE

|

Energy Select Sector

|

Specialty-Natural Res.

|

3.98%

|

9.50%

|

17.60%

|

13.92%

|

14.70%

|

-2.32%

|

|

IYE

|

Dow Jones US Energy

|

Specialty-Natural Res.

|

3.65%

|

9.29%

|

17.56%

|

13.67%

|

14.82%

|

-2.29%

|

|

PXE

|

PowerShares Dyn. Energy Explor.

|

Energy

|

3.62%

|

8.71%

|

18.70%

|

18.51%

|

16.27%

|

-2.70%

|

|

VDE

|

Vanguard Energy VIPERS

|

Specialty-Natural Res.

|

3.61%

|

9.52%

|

17.78%

|

14.80%

|

15.12%

|

-2.27%

|

|

IXP

|

S&P Global Telecommunications

|

Specialty-Commun.

|

3.37%

|

7.57%

|

11.43%

|

11.80%

|

12.65%

|

-0.59%

|

|

PGJ

|

PowerShares Gldn Dragon

|

China

|

3.33%

|

8.90%

|

13.72%

|

7.86%

|

16.62%

|

-5.19%

|

|

EWY

|

iShares S. Korea Index

|

Pacific Asia/excl. Japan

|

3.24%

|

9.59%

|

15.83%

|

12.85%

|

12.96%

|

-1.97%

|

|

IYJ

|

Dow Jones US Industrial

|

Large Blend

|

2.92%

|

7.62%

|

8.69%

|

10.46%

|

10.05%

|

-0.81%

|

|

XLI

|

Industrial Select Sector

|

Large Value

|

2.85%

|

7.44%

|

8.48%

|

9.31%

|

8.77%

|

-0.80%

|

|

EWS

|

iShares Singapore Index

|

Pacific Asia/excl. Japan

|

2.83%

|

8.38%

|

18.19%

|

20.09%

|

19.56%

|

-2.18%

|

|

PPA

|

Aerospace & Defense

|

Aerospace/Defense

|

2.62%

|

7.16%

|

8.62%

|

11.95%

|

11.77%

|

-1.47%

|

|

DIA

|

DIA Diamond EFT

|

Large Value

|

2.48%

|

8.85%

|

9.76%

|

7.95%

|

8.98%

|

-0.84%

|

|

NY

|

NYSE 100 Index

|

Moderate Allocation

|

2.00%

|

6.79%

|

8.13%

|

6.26%

|

7.46%

|

-0.83%

|

|

JKF

|

Morningstar Large Value

|

Large Value

|

1.87%

|

6.35%

|

8.61%

|

6.78%

|

8.22%

|

-1.23%

|

|

OEF

|

S&P 100 Index

|

Large Growth

|

1.65%

|

6.91%

|

8.00%

|

5.42%

|

6.87%

|

-0.94%

|

|

EWG

|

iShares Germany Index

|

Europe Stock

|

1.59%

|

10.66%

|

17.22%

|

18.26%

|

17.88%

|

-1.21%

|

|

XLK

|

Technology Select

|

Specialty-Technology

|

1.59%

|

6.68%

|

8.16%

|

7.18%

|

7.33%

|

-2.16%

|

|

IVE

|

S&P 500/BARRA Value

|

Large Value

|

1.59%

|

6.54%

|

7.63%

|

7.45%

|

8.23%

|

-1.14%

|

|

PBS

|

Dynamic Media

|

Media

|

1.56%

|

5.79%

|

4.62%

|

5.01%

|

7.67%

|

-1.45%

|

|

EWP

|

iShares Spain Index

|

Europe Stock

|

1.52%

|

4.31%

|

9.80%

|

9.31%

|

10.80%

|

-1.51%

|

|

VTV

|

Vanguard Value

|

Large Value

|

1.51%

|

6.30%

|

7.85%

|

6.76%

|

7.90%

|

-1.17%

|

|

IYM

|

Dow Jones US Basic Mat's

|

Large Value

|

1.43%

|

6.76%

|

9.42%

|

16.22%

|

13.61%

|

-1.86%

|

|

EWU

|

iShares United Kingdom Index

|

Europe Stock

|

1.37%

|

4.53%

|

10.16%

|

7.43%

|

7.44%

|

-1.33%

|

|

JKD

|

Morningstar Large Core

|

Large Blend

|

1.31%

|

6.54%

|

6.54%

|

5.12%

|

6.13%

|

-1.19%

|

|

IWD

|

Russell 1000 Value

|

Large Value

|

1.30%

|

5.73%

|

7.10%

|

6.67%

|

7.63%

|

-1.23%

|

|

PEJ

|

PowerShares Dyn. Leisure & Ent.

|

Leisure & Entertainment

|

1.29%

|

3.86%

|

4.50%

|

4.79%

|

6.22%

|

-1.26%

|

|

ELV

|

DJ US LargeCap Value

|

Large Value

|

1.21%

|

6.13%

|

7.59%

|

6.53%

|

7.63%

|

-1.49%

|

|

XLB

|

Materials Select Sector

|

Large Blend

|

1.12%

|

4.87%

|

7.42%

|

14.36%

|

12.13%

|

-1.31%

|

|

DGT

|

DJ Global Titans

|

Large Blend

|

1.11%

|

5.63%

|

7.16%

|

3.84%

|

5.59%

|

-0.80%

|

|

NYC

|

NYSE Composite

|

Moderate Allocation

|

1.09%

|

6.08%

|

8.15%

|

7.43%

|

8.51%

|

-1.21%

|

|

PHO

|

Water Resources

|

Water Resources

|

1.08%

|

5.02%

|

6.27%

|

6.74%

|

7.53%

|

-2.04%

|

|

SPY

|

SPDRS

|

Large Blend

|

1.04%

|

6.23%

|

7.38%

|

6.60%

|

7.19%

|

-1.06%

|

|

IWW

|

Russell 3000 Value

|

Large Value

|

1.04%

|

5.41%

|

6.79%

|

6.31%

|

7.35%

|

-1.24%

|

|

IVV

|

S&P 500

|

Large Blend

|

1.01%

|

6.14%

|

7.29%

|

6.44%

|

7.11%

|

-1.11%

|

|

EWQ

|

iShares France Index

|

Europe Stock

|

0.98%

|

8.36%

|

13.56%

|

11.34%

|

12.22%

|

-1.85%

|

|

VV

|

Vanguard LargeCap

|

Large Blend

|

0.97%

|

6.10%

|

7.35%

|

6.99%

|

7.38%

|

-1.07%

|

|

IJK

|

S&P MidCap 400/BARRA

|

Mid-Cap Growth

|

0.96%

|

6.30%

|

7.58%

|

11.79%

|

9.65%

|

-1.50%

|

|

EWM

|

iShares Malaysia Index

|

Pacific Asia/excl. Japan

|

0.95%

|

8.53%

|

19.39%

|

28.57%

|

22.32%

|

-4.65%

|

|

IOO

|

S&P Global 100

|

World Stock

|

0.94%

|

6.75%

|

9.54%

|

6.88%

|

7.38%

|

-1.09%

|

|

IYG

|

Dow Jones US Financial Serv's

|

Specialty-Financial

|

0.86%

|

5.28%

|

4.16%

|

1.05%

|

3.55%

|

-1.71%

|

|

IWB

|

Russell 1000 Index

|

Large Blend

|

0.85%

|

5.97%

|

6.91%

|

6.88%

|

7.29%

|

-1.14%

|

|

IYY

|

Dow Jones US Tot. Market

|

Large Blend

|

0.84%

|

5.95%

|

6.98%

|

7.08%

|

7.39%

|

-1.26%

|

|

ISI

|

S&P 1500

|

Large Blend

|

0.73%

|

6.02%

|

7.12%

|

6.86%

|

7.24%

|

-1.36%

|

|

EWT

|

iShares Taiwan Index

|

Pacific Asia/excl. Japan

|

0.70%

|

2.66%

|

3.40%

|

-1.45%

|

3.10%

|

-3.83%

|

|

IWV

|

Russell 3000 Index

|

Large Blend

|

0.70%

|

5.75%

|

6.79%

|

6.67%

|

7.15%

|

-1.20%

|

|

XLV

|

Health Care Select SPDR

|

Specialty-Health

|

0.69%

|

8.85%

|

9.11%

|

9.41%

|

7.84%

|

-0.38%

|

|

VTI

|

Total Market VIPERs

|

Large Blend

|

0.69%

|

5.72%

|

6.82%

|

6.73%

|

7.16%

|

-1.25%

|

|

TMW

|

Wilshire 5000 Ttl Mkt

|

Large Blend

|

0.65%

|

5.77%

|

6.97%

|

6.73%

|

7.20%

|

-1.25%

|

|

VAW

|

Vanguard Materials VIPERS

|

Specialty-Natural Res.

|

0.62%

|

5.67%

|

8.57%

|

16.57%

|

13.63%

|

-1.66%

|

|

IVW

|

S&P 500/BARRA Growth

|

Large Growth

|

0.59%

|

6.06%

|

7.19%

|

5.70%

|

6.14%

|

-1.08%

|

|

FXI

|

iShares China 25 Index

|

Pacific Asia/excl. Japan

|

0.57%

|

5.34%

|

13.62%

|

-1.53%

|

12.54%

|

-5.78%

|

|

FEZ

|

Dow Jones Euro Stoxx 50

|

Europe Stock

|

0.55%

|

8.55%

|

13.64%

|

11.05%

|

12.38%

|

-1.70%

|

|

IWF

|

Russell 1000 Growth

|

Large Growth

|

0.54%

|

6.28%

|

6.89%

|

7.28%

|

7.06%

|

-1.02%

|

|

ELG

|

DJ US LargeCap Growth

|

Large Growth

|

0.53%

|

6.04%

|

6.45%

|

6.77%

|

6.77%

|

-1.25%

|

|

EZU

|

European Monetary Union Index

|

Europe Stock

|

0.48%

|

7.90%

|

14.04%

|

12.58%

|

13.05%

|

-1.20%

|

|

VHT

|

Vanguard Health Care

|

Specialty-Health

|

0.47%

|

8.05%

|

8.62%

|

9.34%

|

7.26%

|

-0.51%

|

|

XLF

|

Financial Select Sector

|

Specialty-Financial

|

0.46%

|

5.40%

|

4.28%

|