|

|

|

||

|

|

WEEKLY STATISTICS FOR OUR NO-LOAD MUTUAL FUND AND ETF INVESTMENT PLANS As of Thursday, August 26, 2010 By Ulli G. Niemann |

|

|

|

IN

THIS ISSUE: 1.

General Domestic Equity Mutual Funds/ETFs — BUY 2.

Domestic Equity Funds by Family — BUY 3.

Exchange Traded Funds Master List 4.

Domestic Exchange Traded Funds (ETFs) — BUY 5.

International Equity Mutual Funds/ETFs — SELL 6.

Country ETFs — SELECTIVE BUY 7.

The SimpleHedge Strategy — BUY 8.

Sector Fund Investing (ETFs) — SELECTIVE BUY 9.

Sector Fund Investing (Mutual Funds)

— SELECTIVE BUY 10.

Bond & Dividend paying ETFs — SELECTIVE BUY 11.

Bear Market Funds — SELL 12.

401(k) Funds (domestic) — BUY 13.

New Subscriber Info Weekly Market Comment: The

bears were in charge this week as continued questionable economic data took

the starch out of any upward momentum. Are you interested

in reading my possibly politically incorrect ruminations about the market? I

have set up a blog, aptly named “The Wall Street Bully,” which will be

updated during the week. It gives you the opportunity to post comments and

continue the dialog. Take a look at it: http://thewallstreetbully.blogspot.com/ If

you have a newsreader, you can subscribe to it and new updates will be

delivered to you automatically. Alternatively, you can set this link up in

your ‘Favorites’ folder and check at your convenience. This is a free

service, so please tell some of your friends. GLOSSARY OF TERMS

USED: 1. 4Wk, 8Wk, 12Wk

and YTD refer to how these funds have performed or “appreciated” during these

various time periods. 2. %M/A (39-week

Simple Moving Average) shows how far above or below its long-term trend line a

fund/ETF is currently positioned. 3. “From 6/3/09”

shows a fund’s performance since the date a new domestic Buy Cycle started.

“From 5/11/09” shows a fund’s performance since the date we bought our

International positions. 4. DD% (DrawDown percentage) measures the

drop from a fund’s high to its current price during the past year. A fund

that shows 0.00% has just made a

new high. That’s good news because it confirms that it is moving up given

current economic conditions. It is therefore in tune with market

momentum. Conversely, a fund with a large negative

DD% number is a lagging performer and should not be purchased at this time. 5.

MaxDD% (Maximum DrawDown percentage) is not

shown in these tables, but you will find me mention it quite frequently. If you were to go back 365 days and measure

DD% for a given fund every trading day, and then select the worst (largest)

DrawDown number, you would have the information that

I call MaxDD% (Maximum DrawDown Percentage). This allows me to look back at anytime and

see which funds have held up best and never hit our 7% sell stop. Those are

the ones with a low MaxDD% (low volatility) number and

may be among my primary selections for the next Buy cycle. 6.

M-Index (Momentum Index) shows

the average non-weighted momentum ranking of a fund or ETF. The average is

calculated from the existing 4wk, 8wk, 12wk and YTD momentum numbers. The

higher the number, the more upside momentum a fund has. However, volatility

is increased at the same time. If you’re conservative, drop down a few

numbers from the top of the ranking food chain. The

use of the M-Index was announced in my blog post at: http://thewallstreetbully.blogspot.com/2007/08/introducing-m-index-major-upgrade-to-no.html 1. DOMESTIC EQUITY

MUTUAL FUNDS/ETFs:

BUY—

since 6/3/2009

As

announced via a blog post, on 6/2/2009, the TTI triggered a buy signal with

an effective date of 6/3/2009. We will use the 7% trailing stop loss of our

positions as an exit point or the crossing of the trend line to the downside,

whichever occurs first. As

of today, our Trend Tracking Index (TTI—green line in above chart) has broken

above its long term trend line (red) by +1.98%. Please

note the addition of the blue short-term trend line, which will be used in

section 7 for my hedge strategy.

The

link below shows the top 100 domestic funds (out of 674) and the sorting

order is by M-Index ranking. Prices in all linked tables are updated through

8/26/2010, unless otherwise noted. Price data not yet available at

publication is indicated with 00.00% or -100.00%. Please note, that I

only track no-load, no transaction fee or ‘load waived’ funds, which are

available to me through my custodian Charles Schwab & Co. Since all

brokers and custodians have different policies you need to check with yours

first, before placing any trades, as to no load availability and any charges

or fees involved. I have identified

those funds, which are available to me as “load waived” funds or “advisor

only” funds, with an asterisk before their names. While this may not apply to

all brokerage firms, it should allow you to quickly locate those which are

truly no load. During

this Buy signal, you can use the tables in the links below to make your

selections:

http://www.successful-investment.com/SSTables/DomFundsTop100_082610.pdf TIP: Don’t forget to check

the 401k funds in section 12 as well, since many of them are available for

all types of investment accounts at different brokerage houses. 2. DOMESTIC FUNDS

BY FAMILY: American Century, Fidelity, Vanguard, ProFunds, Rydex, T. Rowe

Price — BUY http://www.successful-investment.com/SSTables/DomFFs082610.pdf 3. EXCHANGE TRADED

FUNDS MASTER LIST As

per request, I have added this ETF Master list so that you can quickly compare

various ETFs without having to reference other tables. The ETFs listed in the

table (476) consist of the following orientations: Domestic, International,

Country, Sector and Specialty. Momentum figures for all ETFs are not adjusted

for dividends. Please

note that I have moved all bear market ETFs to section 11, where they are

listed alongside the bear market mutual funds. http://www.successful-investment.com/SSTables/ETFMaster082610.pdf 4. DOMESTIC

EXCHANGE TRADED FUNDS (ETFs): BUY ETFs

are an excellent alternative to No Load Mutual Funds. They are a valid choice

to high mutual fund management fees, restrictive trading and redemption

charges, which have been a problem for years. If

you’re not sure how to use ETFs please read my FREE article about their pros

and cons, which you may view anytime at: http://www.successful-investment.com/articles24.htm All

the same Buy and Sell rules apply for domestic ETFs as they do for domestic equity mutual funds in

section 1. http://www.successful-investment.com/SSTables/DomETFs082610.pdf 5. INTERNATIONAL

EQUITY MUTUAL FUNDS/ETFs: SELL

On

7/23/10, the International Trend Tracking Index (TTI) moved clearly above its

trend line (red) generating a buy effective 7/26/2010. Currently, the

International TTI has moved back to -1.36% below the dividing line between

bullish and bearish territory. A sell signal was generated on 8/24/2010 with

an effective date of 8/25/2010 as posted on my blog. This now appears to have

been a whipsaw signal as global uncertainty about the economic recovery took center

stage. The

listings in the link below represent some of my choices of the international

funds I track to be used during the next Buy cycle. Please note that I have

added Vanguard, Fidelity, T. Rowe Price, Rydex/ProFunds and American Century

Funds. They are sorted by M-Index ranking: http://www.successful-investment.com/SSTables/InternFunds082610.pdf Be

advised that many international funds may not be available to you since they

carry a load. However, while I am able to purchase these for my managed

account clients as ‘load waived’ funds, this doesn’t help you much, if you do

your own investing. This is why I have included some appropriate ETFs in the

above list. 6. COUNTRY ETFs: SELECTIVE BUY While

I believe that the This

addition to my newsletter will allow us to also invest selectively in

countries with better performing stock markets. With the proliferation of

ETFs over the past years, we are now able to invest in a variety of countries

using low cost index ETFs. The

chart shows the China Index as an example:

The

link contains a list of various countries/regions, which I am tracking

weekly. Please note that data in this table does not include adjustments due

to distributions. http://www.successful-investment.com/SSTables/CountryETFs082610.pdf As

you witnessed during the last couple of years, country funds can be volatile

and the use of a trailing stop loss (I use 10%) is imperative to protect your

portfolio from severe downside moves. 7. THE SimpleHedge STRATEGY: BUY This

section is a continuation of my recently published e-book on hedging for the

mutual fund/ETF investor. If you have not read it, please download your copy

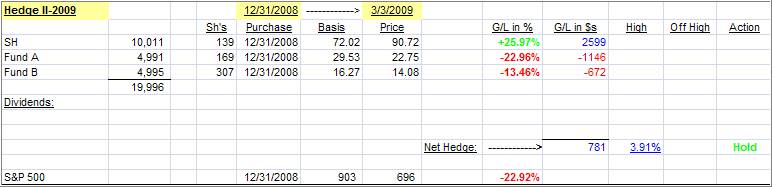

at: http://www.successful-investment.com/SimpleHedge-v1.pdf As

announced, I have added a hedge position for clients using about 20% of

portfolio value. My existing hedge, which was set up on 12/31/2008 is now

showing the following performance updated through 3/3/2009:

As

you can see, the unrealized gain was +3.91%. On 3/3/2009, I had to rebalance

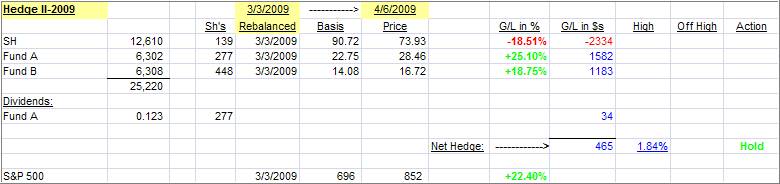

(as described in my e-book) since, due to market conditions, the hedge had

become lopsided in favor of the short position by 61% to 39%. After

rebalancing, the performance from 3/3/2009 to 4/6/2009 now looks as follows:

For

that period, the hedge shows a total unrealized gain of +1.84%. I will

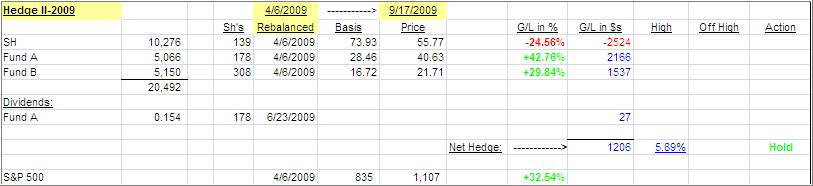

continue to update this table every week. After

rebalancing, the performance from 4/6/2009 to 9/17/2009 now looks as follows:

The

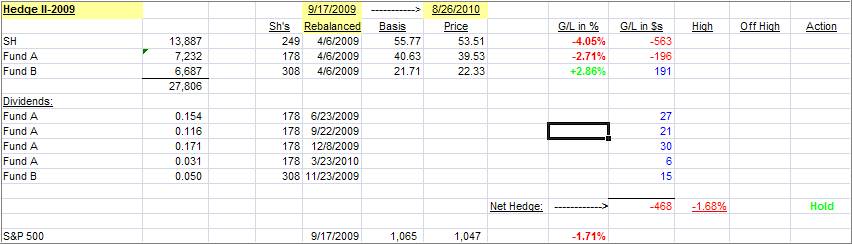

hedge became lopsided again and was rebalanced with the close of the market

on 9/17/09. While there are several

ways to do this, in this case, I simply increased the short positions

bringing the long/short ratio back to 50/50:

8. SECTOR FUND

INVESTING (ETFs): SELECTIVE BUY To

diversify our portfolios, we always need to look for different opportunities

to invest our money. The table of sector fund listings (ETFs) in the

following link covers a broad spectrum of possibilities. The sorting order is

by M-Index: http://www.successful-investment.com/SSTables/SectorETFs082610.pdf I

personally invest no more than 10% of portfolio value in any one sector and

use a 10% trailing stop loss to minimize the risk. 9. SECTOR FUND

INVESTING (Mutual Funds): SELECTIVE BUY If

you prefer using Fidelity’s wide variety of excellent sector funds, you will

like this new addition. Here as well, sectors can be volatile, and I advise

the use of a sell stop just as we do with ETFs. The

sorting order is by M-Index: http://www.successful-investment.com/SSTables/SectorMFs082610.pdf 10. BOND &

DIVIDEND ETFs: SELECTIVE BUY If

you prefer using ETFs for the generation of income, here’s a list of bond and

dividend paying ETFs. It’s important to first look at how these instruments

have held up in terms of momentum figures. Then you should visit your

favorite financial web site to examine yield and other details. http://www.successful-investment.com/SSTables/Bond_DivETFs082610.pdf 11. BEAR MARKET

FUNDS:

SELL

The

above indicator represents our Short Fund Composite (SFC) to be used as a

trend indicator for Bear Market Funds. The

SFC has broken above its long-term trend line by +2.58%, which means we are

back above the line after briefly venturing above it. As in the past, I will

not take any action until the domestic TTI (section 1) has clearly broken

into bear market territory. Below

are the most commonly available bear market funds/ETFs and their momentum

figures: http://www.successful-investment.com/SSTables/BearFunds082610.pdf Please

note that some of the above funds try to outperform the index they are tied

to by the percentage stated. While this can enhance your returns it can

certainly accelerate your losses as well. No matter which way you choose, be

sure to work with a trailing sell stop and be aware that volatility will be

your constant companion. 12. 401(k) FUNDS

(domestic): BUY The

list (featured in the link below) displays commonly held 401(k) domestic equity mutual funds showing

their latest momentum figures to go along with the Buy and Sell signals of

the TTI in section 1. The same stop loss rules apply here as well. Since

fund choices are limited in any 401k plan, be sure to roll your assets into

an IRA if you leave your job. Let me know if you need help with that. In

the meantime, however, you can benefit greatly by at least not buying the

worst fund at the wrong time. If you follow our plan, you will never again

buy one of those highly volatile sector funds, when you really should be out

of the market altogether. The

sorting order is now also by M-Index. http://www.successful-investment.com/SSTables/401k082610.pdf 13. New Subscriber

Information To get you a head

start on more successful investing, please click on: http://www.successful-investment.com/newsletter/How_to_use.pdf and download our “How to use” information sheet and

recent “Buy Signal” information: http://www.successful-investment.com/weekly/BuySignal042803.pdf The use of Trailing

Sell Stops is an important ingredient to a successful trend tracking

strategy. Download our complete 70 page PDF file on the subject at: http://www.successful-investment.com/SellStopDiscipline.pdf Also, my daily blog

posts at http://thewallstreetbully.blogspot.com/ should help you to

become more familiar with my approach as well as our Investment Policy

Statement at: http://www.successful-investment.com/InvPolicyStatement.pdf If

you still need some guidance, feel free to contact me. Special Notes: 1.

I have taken great care in selecting only mutual funds with no loads and no

redemption fees. However, policies vary from one brokerage house to another.

Before placing any trade, make sure to verify with your broker or custodian

as to any charges and fees involved. 2.

Be aware that, because of the mutual fund scandals, some fund families have

added early redemption fees. While some are reasonable (30 days), others are

ridiculous by trying to tie up the individual investor for 180 days, or

you’re being charged a 2% fee to opt out early. Be sure to check first before

placing any order. 3.

Should there be a sudden change in investment positions, I will post a notice

at my blog. If

you are interested in having your portfolio professionally managed using our

methodology, feel free to contact me directly or visit our website http://www.successful-investment.com/money_management.htm for more information. My

e-mail is ulli@successful-investment.com and my phone is

714.841.5804 Until

next week. Ulli… ========================= Ulli G. Niemann Registered

Investment Advisor 714.841.5804 =========================

DISCLAIMER (c) Copyright

Successful-Investment.com, 2003. All rights reserved. No portion of the above

message may be republished, retransmitted or forwarded without our express

written consent. Violation of this copyright may result in service

cancellation. Use and/or reliance on this service are strictly at the

subscriber's own risk. Subscriber must maintain compliance with our Terms and

Conditions. We will not be liable for the acts or omissions of any third

party with regards to delay or non-delivery of the 'Successful-Investment' notification.

We shall not be liable for incidental, indirect, special or consequential

damages or for lost profits, savings or revenues of any kind, whether or not

we have been advised of the possibility for such damages. Ulli G. Niemann is a registered investment

advisor pursuant to the California Department of Corporations. The

information presented herein is for informational purposes only and does not

constitute an offer to sell securities or investment advisory services. Such

an offer can only be made in those states we have established a

"notice-filing" status or where an exemption from notification is

currently available under the de minimis exemption rule. The investment advisor is an independent

advisor and receives no compensation from any corporations, brokerage houses,

organizations or special interest groups by making recommendations to

purchase any of the investment products used. The advisor is a fee-only

advisor and receives no commissions for client trades. |

|||