|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

WEEKLY STATISTICS FOR OUR NO-LOAD MUTUAL FUND AND ETF INVESTMENT PLANS As of Thursday, June 26, 2008 By Ulli G. Niemann |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

IN THIS ISSUE: 1. General Domestic

Equity Mutual Funds — SELL 2. Domestic Equity

Funds by Family — SELL 3. Exchange Traded

Funds Master List 4. Domestic Exchange

Traded Funds (ETFs) — SELL 5. International

Equity Mutual Funds/ETFs — SELL 6. Country ETFs

— SELL 7. Tax-Free

Investing — SELL 8. Sector Fund

Investing (ETFs) — SELECTIVE

BUY 9. Sector Fund

Investing (Mutual Funds) — SELECTIVE

BUY 10. Bond &

Dividend paying ETFs — SELECTIVE BUY 11. On the Horizon:

Bear Market Funds — BUY 12. 401(k) Funds

(domestic) — SELL 13. New Subscriber

Info Weekly Market Comment: Blood in

the streets is what describes this week’s market activity best as all major

indexes suffered defeat and the bears feasted on some bull carcasses. Our

hedged positions actually gained in value while just about any investment

arena was affected negatively. Are you interested in reading my

possibly politically incorrect ruminations about the market? I have

set up a blog, aptly named “The Wall Street Bully,” which will be updated

during the week. It gives you the opportunity to post comments and continue

the dialog. Take a look at it: http://thewallstreetbully.blogspot.com/ If you

have a newsreader, you can subscribe to it and new updates will be delivered

to you automatically. Alternatively, you can set this link up in your

‘Favorites’ folder and check at your convenience. This is a free service, so

please tell some of your friends. GLOSSARY OF TERMS USED: 1. 4Wk, 8Wk, 12Wk and YTD refer to

how these funds have performed or “appreciated” during these various time

periods. 2. %M/A (39-week Simple Moving Average)

shows how far above or below its long-term trend line a fund/ETF is currently positioned. 3. “Since 9/6/06” shows a fund’s

performance since that date. This date will be re-set once a new domestic Buy

Cycle starts. 4. DD% (DrawDown percentage) measures the drop from a

fund’s high to its current price during this Buy cycle (since is moving up given current given

economic conditions—which were favorable at the time. It is therefore in tune

with market momentum. Conversely, a fund with a large negative DD% number is a

lagging performer and should not be purchased at this time. 5. MaxDD%

(Maximum DrawDown percentage) is not

shown in these tables, but you will find me mention it quite frequently. If you were to go back to the beginning of the previous

Buy cycle ( trading day, and then select the worst (largest) DrawDown

number, you would have the information that I call MaxDD% (Maximum DrawDown Percentage). This allows me to look back at anytime and see which funds

have held up best and never hit our 7% sell stop. Those are the ones with a low MaxDD% (or low volatility)

number and may be among my primary selections for the next Buy cycle. 6.

M-Index (Momentum Index) shows

the average non-weighted momentum ranking of a fund or ETF. The average is

calculated from the existing 4wk, 8wk, 12wk and YTD momentum numbers. The

higher the number, the more upside momentum a fund has. However, volatility

is increased at the same time. If you’re conservative, drop down a couple

numbers from the top of the ranking food chain. The use

of the M-Index was announced in my blog post at: http://thewallstreetbully.blogspot.com/2007/08/introducing-m-index-major-upgrade-to-no.html 1. DOMESTIC EQUITY MUTUAL FUNDS: SELL

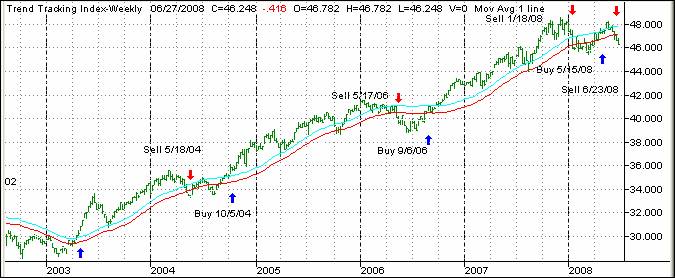

Our Trend

Tracking Index (TTI) moved sharply lower this week (green line in above

chart) confirming our Sell signal effective 6/23/08. The TTI has now broken below

its long term trend line (red) by -1.81%. As mentioned

in my blog, I have chosen to keep some of our fund holdings and hedge them

with the short S&P 500 (SH), which so far has worked in our favor. If the

market signals a new Buy, I will remove the hedge and become net long; if the

market sinks further into oblivion, I may remove the long holdings and become

net short. My Buy rules are as follows: I will move back in the domestic

arena (net long) if the above domestic Trend Tracking Index (TTI) moves out

of its neutral zone and above a point, which is +1.5% above its long-term trend

line (blue).

The link

below shows the top 100 domestic funds (out of 674) and the sorting order is

by M-Index ranking. Prices in all linked tables are updated through 6/26/2008,

unless otherwise noted. Price data not yet available at publication is

indicated with 00.00% or -100.00%. Please note, that I only track

no-load, no transaction fee or ‘load waived’ funds, which are available to me

through my custodian Charles Schwab & Co. Since all brokers and

custodians have different policies you need to check with yours first, before

placing any trades, as to no load availability and any charges or fees

involved. I have identified those

funds, which are available to me as “load waived” funds or “advisor only”

funds, with an asterisk before their names. While this may not apply to all

brokerage firms, it should allow you to quickly locate those which are truly

no load. Once the

next Buy signal is generated, you can use the tables in the links below to

make your selections:

http://www.successful-investment.com/SSTables/DomFundsTop100_062608.pdf Important

note: Due to a data base error, some funds like JORNX and WLGYX are currently

not listed in the Top 100. I am working on fixing this problem and will let you

know as soon as it has been resolved. TIP: Don’t forget to check the 401k

funds in section 12 as well, since many of them are available for all types

of investment accounts at different brokerage houses. 2. DOMESTIC FUNDS BY FAMILY:

American Century, Fidelity, Vanguard, ProFunds,

Rydex, T. Rowe Price — SELL http://www.successful-investment.com/SSTables/DomFFs062608.pdf 3. EXCHANGE TRADED FUNDS MASTER

LIST As per request,

I have added this ETF Master list so that you can quickly compare various

ETFs without having to reference other tables. The ETFs listed in the table

(476) consist of the following orientations: Domestic, International,

Country, Sector and Specialty. Momentum figures for all ETFs are not adjusted

for dividends. Please

note that I have moved all bear market ETFs to section 11, where they are

listed alongside the bear market mutual funds. http://www.successful-investment.com/SSTables/ETFMaster062608.pdf 4. DOMESTIC EXCHANGE TRADED FUNDS

(ETFs): SELL ETFs are

an excellent alternative to No Load Mutual Funds. They are a valid choice to

high mutual fund management fees, restrictive trading and redemption charges,

which have been a problem for years. If you’re

not sure how to use ETFs please read my FREE article about their pros and

cons, which you may view anytime at: http://www.successful-investment.com/articles24.htm All the

same Buy and Sell rules apply for domestic ETFs as they do for domestic equity mutual funds in

section 1. http://www.successful-investment.com/SSTables/DomETFs062608.pdf 5. INTERNATIONAL EQUITY MUTUAL

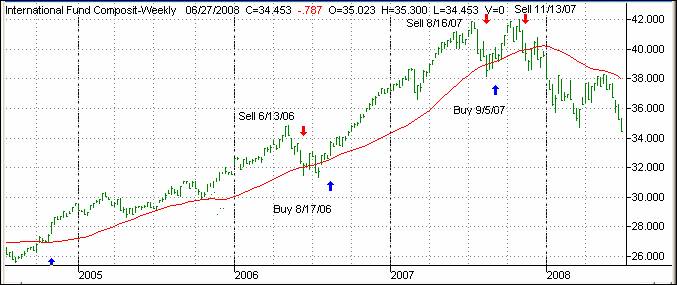

FUNDS/ETFs: SELL — since 11/13/2007 Last

Cycle from 9/5/2007 – 11/13/2007

As of

today, the International Index has now broken below its trend line by -9.69%.

We remain on the sidelines. The

listings in the link below represent some of my choices of the international

funds I track to be used when the next Buy signal occurs. Please note that I

have added Vanguard, Fidelity, T. Rowe Price, Rydex/ProFunds

and American Century Funds. They are sorted by M-Index ranking: http://www.successful-investment.com/SSTables/InternFunds062608.pdf Be advised

that many international funds may not be available to you since they carry a

load. However, while I am able to purchase these for my managed account

clients as ‘load waived’ funds, this doesn’t help you much, if you do your

own investing. This is why I have included some appropriate ETFs in the above

list. 6. COUNTRY ETFs: SELL While I

believe that the This addition

to my newsletter will allow us to also invest selectively in countries with

better performing stock markets. With the proliferation of ETFs over the past

years, we are now able to invest in a variety of countries using low cost

index ETFs. The chart

shows the Pacific Asia Index as an example:

The link

contains a list of various countries/regions, which I am tracking weekly.

Please note that data in this table does not include adjustments due to

distributions. http://www.successful-investment.com/SSTables/CountryETFs062608.pdf As you

witnessed during the last couple of years, country funds can be volatile and

the use of a trailing stop loss (I use 10%) is imperative to protect your

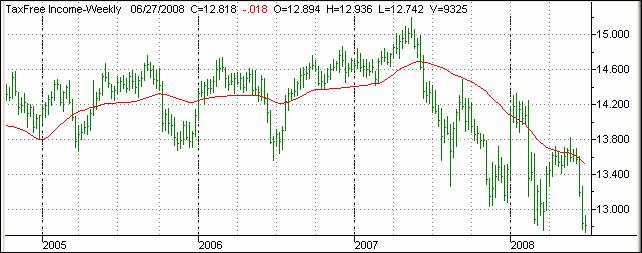

portfolio from severe downside moves. 7. TAX-FREE INVESTING: SELL This

section shows some of the Closed End Exchange Traded Bond Funds (CEETBFs) as

discussed in my free e-Book “How to

Earn 5% - 6.5% Tax-Free Income,” which can be downloaded from my site. This new

addition to the StatSheet is a managed account service I offer. Choosing the

right CEETBF out of over 500 takes a lot of work to customize a selection of

funds specifically suited to your needs. To

identify the general trend of these funds, I have created the TFI-Index, as

illustrated in the chart below. If the Index (green line) is above its

long-term trend line (red), we are in an environment of lower interest rates.

If it breaks below it, we are seeing interest rates rising. Note: In light of current overall credit

problems, which have affected the municipal market as well, I currently can’t

recommend any investments in this arena.

The table

below is a small sampling of what is available. Be advised that the columns

“Discount,” “Current Dividend Yield,” and “YTD” are updated weekly so that

you can see and track the impact changes in interest rates are having. The

data is as of 6/25/2008:

Please

note that many of these funds have been around for a long time and therefore

10-yr annualized returns are available for most of them. All of them are exempt from Federal taxation and,

depending on what state you live in, maybe exempt from State taxation as

well. Here’s

the glossary of terms used: 1. 1 Yr

Return*: The return over the last 12 months consisting of appreciation and

reinvested dividends. 2. Since

Inception*: The annualized return since the fund started operating. 3. 10 Yr

Annualized Return*: The annualized return over the past 10 years. 4.

Discount from NAV: The discount or premium from Net Asset Value (NAV) this

fund can be currently purchased for. 5.

Average Credit Rating: A key number which shows the quality of the fund with

AAA being the highest. The percentage shows how much of the funds holdings,

as a percentage, are in AAA rated bonds. 6.

Morningstar (MS): The current Morningstar rating. NR means that it is not yet

rated. 7.

Current Div. Yield: That’s the income being generated and it is paid out on a

monthly basis, if you wish. This represents spendable

income. 8. YTD:

Shows the Year-To-Date performance (without dividends) to demonstrate the

effect of changes in interest rates. Some funds are showing capital gains,

other capital losses. This is a very short-term view. These types of

investments should only be made with at least a 5-year time horizon. There are

many other factors, which come into play, when evaluating CEETBFs. This

section is only designed as an introduction. If you do your own investing in

this area, be sure to read my new article titled “The 10 Rules of Successful Tax-Free Income Investing,” which is

posted at: http://www.successful-investment.com/articles31.htm If you

have a need to generate reliable monthly income, please call me, or go the

following link and submit your request: http://www.successful-investment.com/TFI *As of 8. SECTOR FUND INVESTING (ETFs): SELECTIVE BUY To

diversify our portfolios, we always need to look for different opportunities to

invest our money. The table of sector fund listings (ETFs) in the following

link covers a broad spectrum of possibilities. The sorting order is by

M-Index: http://www.successful-investment.com/SSTables/SectorETFs062608.pdf I

personally invest no more than 10% of portfolio value in any one sector and

use a 10% trailing stop loss to minimize the risk. 9. SECTOR FUND INVESTING (Mutual

Funds): SELECTIVE BUY If you

prefer using Fidelity’s wide variety of excellent sector funds, you will like

this new addition. Here as well, sectors can be volatile, and I advise the

use of a sell stop just as we do with ETFs. The

sorting order is by M-Index: http://www.successful-investment.com/SSTables/SectorMFs062608.pdf 10. BOND & DIVIDEND ETFs: SELECTIVE BUY If you

prefer using ETFs for the generation of income, here’s a list of bond and

dividend paying ETFs. It’s important to first look at how theses instruments

have held up in terms of momentum figures. Then you should visit your

favorite financial web site to examine yield and other details. http://www.successful-investment.com/SSTables/Bond_DivETFs062608.pdf 11. ON THE HORIZON: Bear Market

Funds: BUY

The above

indicator represents our Short Fund Composite (SFC) to be used as a trend

indicator for Bear Market Funds. The SFC

has now broken back above its long-term trend line by +5.03%. With our TTI

(section 1) now in bear market territory, this constitutes a current buy of

bear market funds and ETFs. I will not participate, since I have decided to

hedge my long position as described in section 1 and in previous blog posts. Below are

the most commonly available bear market funds/ETFs and their momentum

figures: http://www.successful-investment.com/SSTables/BearFunds062608.pdf Please

note that some of the above funds try to outperform the index they are tied

to by the percentage stated. While this can enhance your returns it can

certainly accelerate your losses as well. No matter which way you choose, be

sure to work with a trailing sell stop and be aware that volatility will be your

constant companion. 12. 401(k) Funds (domestic): SELL The list

(featured in the link below) displays commonly held 401(k) domestic equity mutual funds showing

their latest momentum figures to go along with the Buy and Sell signals of

the TTI in section 1. The same stop loss rules apply here as well. Since

fund choices are limited in any 401k plan, be sure to roll your assets into

an IRA if you leave your job. Let me know if you need help with that. In the

meantime, however, you can benefit greatly by at least not buying the worst

fund at the wrong time. If you follow our plan, you will never again buy one

of those highly volatile sector funds, when you really should be out of the

market altogether. The

sorting order is now also by M-Index. http://www.successful-investment.com/SSTables/401k062608.pdf 13. New Subscriber Information To get you a head start on more

successful investing, please click on: http://www.successful-investment.com/newsletter/How_to_use.pdf and download our “How to use” information sheet and

last year’s “Buy Signal”

information: http://www.successful-investment.com/weekly/BuySignal042803.pdf Also, my daily blog posts at http://thewallstreetbully.blogspot.com/

should help you to become more familiar with my approach as well as our

Investment Policy Statement at: http://www.successful-investment.com/InvPolicyStatement.pdf If you

still need some guidance, feel free to contact me. Special Notes: 1. I have

taken great care in selecting only mutual funds with no loads and no

redemption fees. However, policies vary from one brokerage house to another.

Before placing any trade, make sure to verify with your broker or custodian

as to any charges and fees involved. 2. Be

aware that, because of the mutual fund scandals, some fund families have

added early redemption fees. While some are reasonable (30 days), others are

ridiculous by trying to tie up the individual investor for 180 days, or

you’re being charged a 2% fee to opt out early. Be sure to check first before

placing any order. 3. Should

there be a sudden change in investment positions, I will post a notice at my

blog. If you

are interested in having your portfolio professionally managed using our

methodology, feel free to contact me directly or visit our website http://www.successful-investment.com/money_management.htm

for more information. My e-mail

is ulli@successful-investment.com

and my phone is 714.841.5804 Until

next week. Ulli… ========================= Ulli G. Niemann Registered Investment Advisor 714.841.5804 =========================

DISCLAIMER (c) Copyright

Successful-Investment.com, 2003. All rights reserved. No portion of the above

message may be republished, retransmitted or forwarded without our express

written consent. Violation of this copyright may result in service

cancellation. Use and/or reliance on this service are strictly at the

subscriber's own risk. Subscriber must maintain compliance with our Terms and

Conditions. We will not be liable for the acts or omissions of any third

party with regards to delay or non-delivery of the 'Successful-Investment'

notification. We shall not be liable for incidental, indirect, special or

consequential damages or for lost profits, savings or revenues of any kind,

whether or not we have been advised of the possibility for such damages. Ulli G. Niemann is a registered investment

advisor pursuant to the California Department of Corporations. The

information presented herein is for informational purposes only and does not

constitute an offer to sell securities or investment advisory services. Such

an offer can only be made in those states we have established a

"notice-filing" status or where an exemption from notification is

currently available under the de minimis exemption rule. The investment advisor is an independent

advisor and receives no compensation from any corporations, brokerage houses,

organizations or special interest groups by making recommendations to

purchase any of the investment products used. The advisor is a fee-only

advisor and receives no commissions for client trades. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||